Content

The adjusting entry will be dated Dec. 31 and will have a debit to the salary expenses account on the income statement and a credit to the salaries payable account on the balance sheet. Tuition payments received that are to be deferred have an additional debit to a campus-level income account and a credit to deferred revenue liability. accrued liabilities are costs incurred in an accounting period Similarly, expenses that are to be accrued have an additional credit to a campus-level expense account and a debit to prepaid expense asset. In order for a student account transaction to participate in the accrual process, two conditions must be met. First, the item type must belong to an item type group defined for this purpose.

Identify the financial statement/s where each of the following items appears. Use I for income statement, B for balance sheet, and E for statement of retained earnings. This adjusting entry records months A’s portion of the interest expense with a journal entry that debits interest expense and credits interest payable. For instance, if the business purchases supplies for $1,000, accounting records will show a debit to Office Supply Expense and a credit to the Cash account.

What is an Accrued Liability?

There are two main methods of accounting, accrual method and cash basis method. Simply put, if the revenue is earned in June, it is recorded to the income statement in June, regardless of when the entity received payment from the customer. This method differs from the cash basis method which records revenues and expenses only when monies are exchanged. The basis of accounting determines the timing for reporting measurements made on a cash or accrual basis in the State’s financial statements.

Are accrued expenses costs incurred in a period that are both unpaid and unrecorded?

Accrued expenses—refer to costs that are incurred in a period but are both unpaid and unrecorded. They are expenses that are incurred during the accounting period, but the cash has not been paid out at the end of the period.

When the grocery store needs to restock and order milk, it incurs an expense whether the order gets paid upon delivery or in net terms. The expenses incurred would then be part of the Cost of Goods or Services sold. In the second period, the journal entry is reversed and the supplier invoice is entered, for a net zero entry in the second period.

Understanding Accrued Liability

The company then receives its bill for the utility consumption on March 05 and makes the payment on March 25. Bad debt expense is an expense that a business incurs once the repayment of credit previously extended to a customer is estimated to be uncollectible. An accrued expense is recognized on the books before it has been billed or paid. Examples of accrued liabilities can include payroll and payroll taxes. Accrued expenses are recognized on the books when they are incurred, not when they are paid. Service potential The benefits that can be obtained from assets.

The accrual method gives you an accurate picture of your business’s financial health. But, it can be hard to see the amount of cash you have on hand. So as you accrue liabilities, remember that that is money you’ll need to pay at a later date.

Journal Entry for an Accrued Liability

For accounting purposes, these expenses are recorded when they are incurred, regardless of when they are actually paid. The balance in the discount on bonds payable account would be reported on the balance sheet in the? Accounting records can be maintained through the cash or accrual basis of accounting. Under the accrual basis, the revenue and expense should be recorded when earned and incurred. An adjusting entry for accrued salaries expenses is made to recognize the wages earned by employees but not yet paid.

- For instance, a grocery store needs to purchase milk from the manufacturer to sell to its customers.

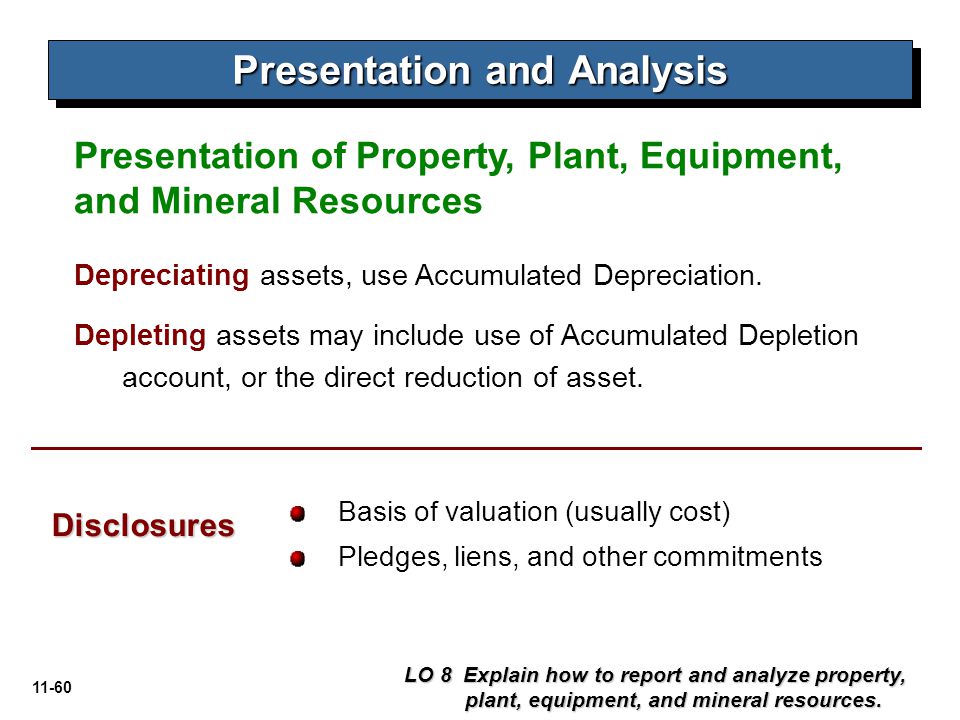

- Book value For depreciable assets, book value equals cost less accumulated depreciation.

- At the beginning of the next period, they have to reverse some accruals.

- Balance SheetA balance sheet is one of the financial statements of a company that presents the shareholders’ equity, liabilities, and assets of the company at a specific point in time.

- Accrued expenses are recognized by debiting the appropriate expense account and crediting an accrued liability account.

An accrued liability is an obligation that an entity has assumed, usually in the absence of a confirming document, such as a supplier invoice. The most common usage of the concept is when a business has consumed goods or services provided by a supplier, but has not yet received an invoice from the supplier. The purpose of an accrued liability entry is to record an expense or obligation in the period when it was incurred. Accrued ExpensesAn accrued expense is the expenses which is incurred by the company over one accounting period but not paid in the same accounting period. In the books of accounts it is recorded in a way that the expense account is debited and the accrued expense account is credited.

Data are transferred from asset and liability accounts to expense and revenue accounts. Examples are prepaid expenses, depreciation, and unearned revenues. Classified balance sheet Subdivides the three major balance sheet categories (assets, liabilities, and stockholders’ equity) to provide more information for users of financial statements. Assets may be divided into current assets; long-term investments; property, plant, and equipment; and intangible assets. Liabilities may be divided into current liabilities and long-term liabilities. Accounting cycle Series of steps performed during the accounting period to analyze, record, classify, summarize, and report useful financial information for the purpose of preparing financial statements.

- The concept of an accrued liability relates to timing and the matching principle.

- Read on to learn the basics of accrued liabilities to keep your small business cash flow on track.

- We need to record this expense as an accrued liability in the books of accounts.

- Estimated residual value The amount that the company can probably sell the asset for at the end of its estimated useful life.

- Accrued expenses are important for adhering to the matching principle, which states that revenues and expenses should be recognized in the same accounting period in which they are earned or incurred.

- Typical examples of prepaid expenses include prepaid insurance premiums and rent.

- However, these accruals should be recognized only if measured objectively.