Content

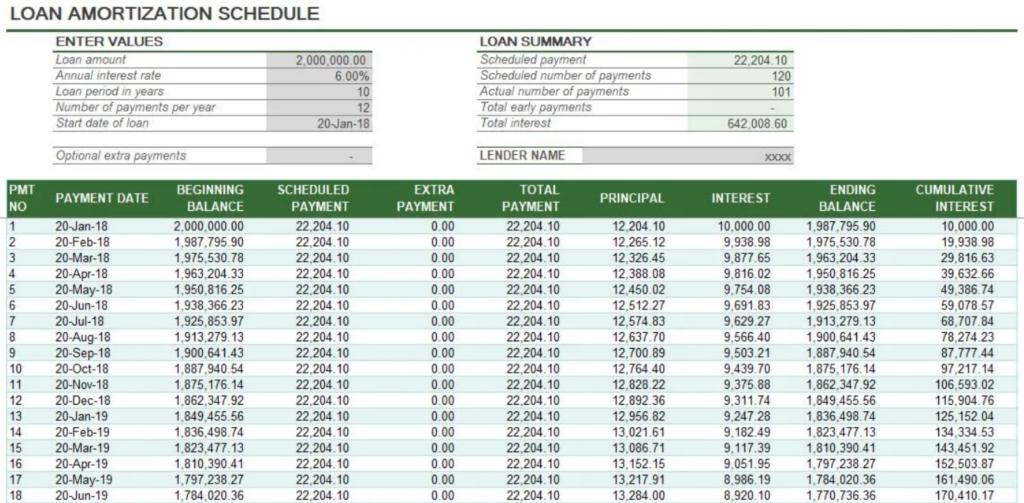

Explain how a company can have positive net income–perhaps even outstanding earnings–for a month or quarter but have negative cash flow from operations. Explain why these items are usually disclosed separately on income statements. The reverse method is FIFO, where the oldest stock is recorded as the primary bought. While the business may not be actually selling the latest or oldest inventory, it makes use of this assumption for cost accounting functions.

Phantom profit refers to the company’s profit using a different form of accounting. Merchandise costing $46,000 which was shipped by Oliva f.o.b. shipping point to a customer on December 29, 2017. Thecustomer was scheduled to receive the merchandise on January 2, 2018. Merchandise costing $38,000 which was shipped by Oliva f.o.b. destination to a customer on December 31, 2017. The customerwas expected to receive the merchandise on January 6, 2018.

After-tax profit margin

Explain how inventory turnover affects the amount of cash that must be invested in inventory. Would an analyst consider cost of goods sold more useful if computed using LIFO or FIFO? Note that this policy may change as the SEC manages SEC.gov to ensure that the website performs efficiently and remains available to all users. To ensure our website performs well for all users, the SEC monitors the frequency of requests for SEC.gov content to ensure automated searches do not impact the ability of others to access SEC.gov content. We reserve the right to block IP addresses that submit excessive requests. Current guidelines limit users to a total of no more than 10 requests per second, regardless of the number of machines used to submit requests.

How is phantom profit calculated?

The amount of phantom or illusory profit is the difference between the profit reported using historical cost—as required by generally accepted accounting principles (GAAP)—and the profit that would have been reported if replacement cost had been used.

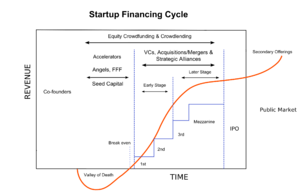

After forming your plan, you can put it into action by first informing eligible parties of the plan’s availability and offering access to it. You can then remind your team of the company objectives before officially executing the plan. A physical inventory on March 31, 2017, shows 1,600 units on hand. A business executive once stated, ‘Depreciation is one of our biggest operating cash inflows’. Describe the circumstances under which a manager might want to change her firm’s inventory method from FIFO to LIFO. Also, describe why a change from LIFO to FIFO might be desirable.

RELATED QUESTIONS

Compute the cost of goods sold assuming periodic inventory procedures and inventory priced at FIFO. Assuming that periodic inventory records are kept in units only, compute the inventory at April 30 using LIFO and average-cost. phantom profit is the result of using the FIFO method during an inflationary period. Phantom profit is a result of FIFO inventory in an inflationary period.

- Explain where a “gain on sale of assets” goes on the cash flow statement.

- A larger COGS creates a decrease, though not essentially practical, internet earnings and reduces taxes.

- This victim of inflation is the accounting principle of calculating depreciation based on historical cost.

- The business did well the previous year and makes a profit of $20,000.

- Cost of products sold is then subtracted from revenues to assist decide the business’s profit for the 12 months.

- This doesn’t fit nicely with GAAP necessities for realistic net earnings because you match out of date prices with probably the most present revenues.

In small business, the term describes income reported to the IRS that an individual has not received. How many daily decisions, involving how much money, are based on the information produced by accounting procedures and summarized on balance sheets and income statements? We do know that millions of private investors, as well as businessmen, institutions, financial analysts, editors, attorneys, legislators, bureaucrats and others use this information for a multitude of purposes. The news media grind out a constant barrage of propaganda about private business, using published financial statements as a primary source of data. Legislatures construct laws, particularly tax laws, guided by the same data. During periods of inflation the amount of phantom or illusory profits will be reduced if the last-in, first-out cost flow assumption is used.

Partners

This is the problem that happens when the LIFO base year or layer is forcibly reduced. The LIFO base or layer is reduced due to the reduction in ending inventory at base cost in the subsequent year. Thus, as a result, irrelevant and old costs are matched with the current revenues leading to the problem of net income distortion.

Thus, the related depreciation accounting is economically fallacious. A financial statement measuring the profit or loss of a business income less expenses for an accounting period. Net investment income is the total of payments received from assets such as bonds, stocks, and mutual funds, loans, minus the related expenses.